Microenterprise Loans Support Local Businesses

Woodlands is pleased to have the support of USDA-Rural Development (USDA RD) in providing lending and technical assistance to small businesses in our region. Through USDA RD we are able to borrow money that we turn around and lend to small businesses in our region. Through this program the federal government counts on organizations like ours to distribute their money in a way that positively impacts business development in our area.

Since 2015, Lenders has borrowed $1 million in loan capital from USDA-Rural Development through its Rural Microenterprise Assistance Program (RMAP) and lent more than $1.3 million to 40 small business owners needing $5-$50,000 to get started or expand. These loans have attracted an additional $330,000 in financing or equity to these businesses. Since small businesses are the primary source of jobs in rural areas, this federal investment is critical to our local economy.

RMAP is a revolving loan fund, meaning that Lenders borrows the money from USDA RD to loan to businesses. As we deploy the money into your towns and communities and the loans are repaid, we repay our loan from USDA RD. They can turn those dollars around and lend it back out to us or other local CDFIs.

CDFIs are able to lend to small businesses or groups that might be too risky to qualify for financing from a conventional lending institution. CDFI lending is a way for your idea to get a chance, for a business in a small town to get a foot in the financing door.

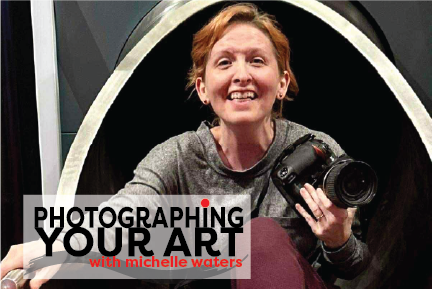

Paint it Black 6: Photographing Your Artwork

Michelle Waters, Photographer October 13th, Old Brick Playhouse, Elkins, WV Register here Photographing Your Art with Michelle Waters Photographer Michelle Waters will share the best tips, tricks and tools ...

Read More

Green Building Initiative: Conditioned Crawl Spaces

Since our inception in the mid-1990s Woodlands has been pushing the envelope and including green building practices on every project. Wrapped in the final package of a finished house, ...

Read More

Mon Forest Towns Initiative Awarded $1.89 ARC POWER Grant

Elkins, West Virginia, October 16, 2024 — Woodlands Community Lender, on behalf of the Mon Forest Towns Partnership, has been awarded $1,897,136 by the Appalachian Regional Commission (ARC) to ...

Read More