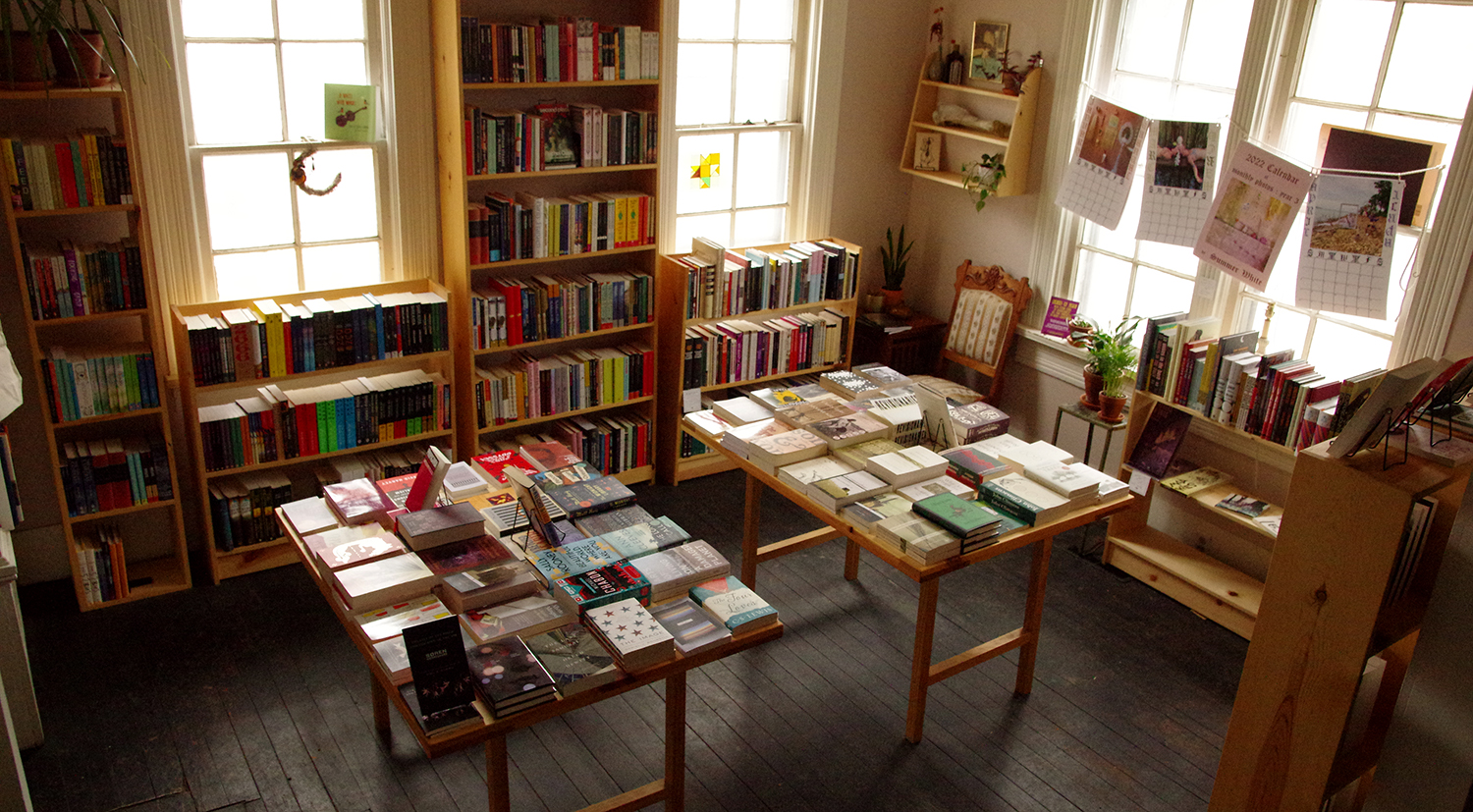

Community Lending

Grow your business with Woodlands

At Woodlands our mission is to work with borrowers who want to start or grow businesses and lack access to capital, funds, or technical experience for any reason.

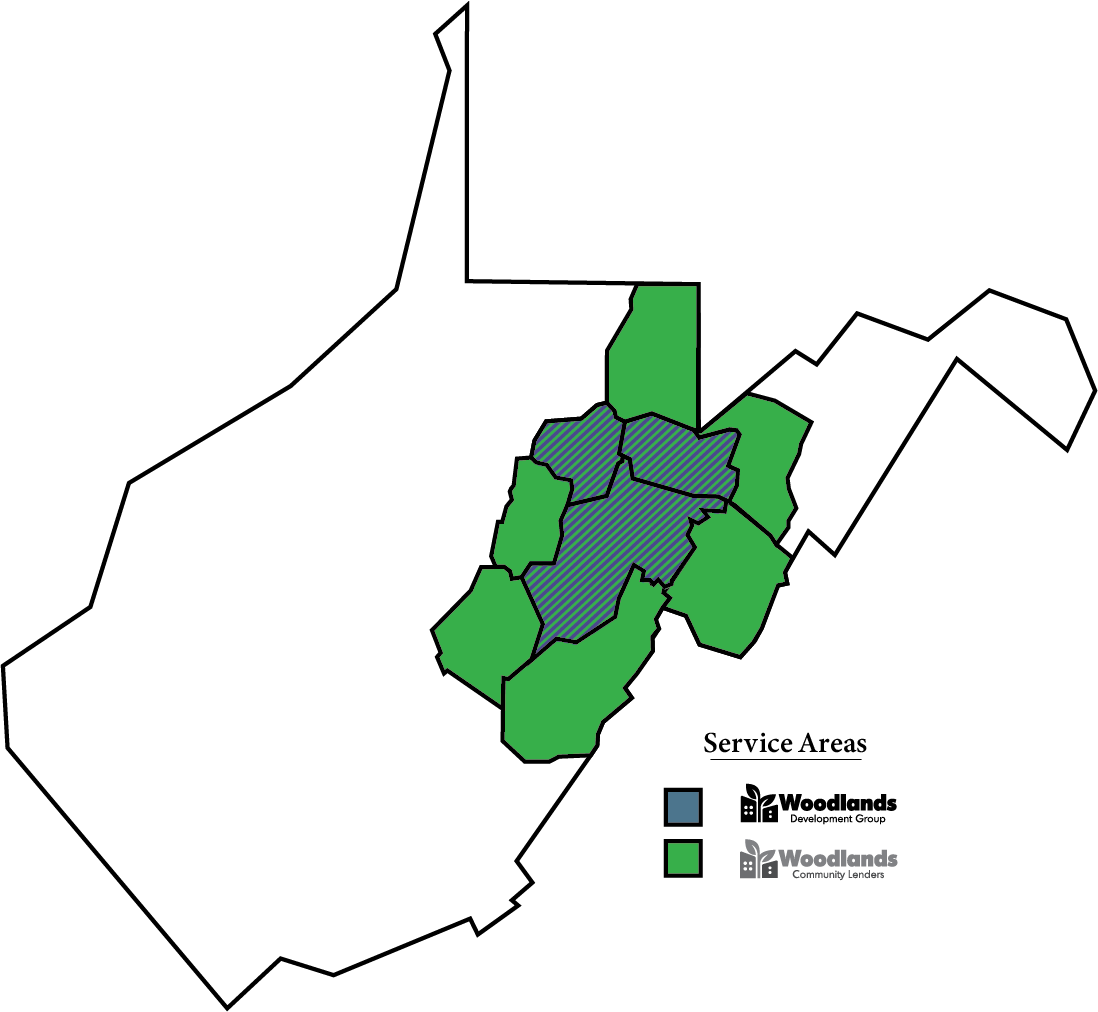

Woodlands is a CDFI which is a type of lender that is designed to provide responsible, affordable lending to borrowers and communities that are under-served by traditional financial systems. Woodlands makes these loans available to anyone in West Virginia to launch or grow businesses, social enterprises, and support community development projects.

By working with our clients and offering technical and business assistance we are able to mitigate risk and offer loans to someone who might not qualify on the commercial loan market. By being a CDFI we are not only able but required to provide opportunities for low-income and persistent poverty communities to lift themselves out of those designations.

Talk to us about commercial loans and gap financing. We offer cost free technical assistance, financial consulting, and business planning. We can provide you access to low or no-cost services like accounting, attorneys, marketing specialists, web developers, and many other forms of technical assistance.